39+ mortgage interest deduction limitation

Web mortgage interest deduction limit home mortgage interest limitation calculation mortgage interest deduction limit refinance mortgage interest deduction. Web Home mortgage interest limitation worksheet line F4 amount borrowed in 2020 The only thing turbotax filled in on.

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Access IRS Tax Forms.

. Homeowners who bought houses before. The deduction is not available for loans. Web March 4 2022 439 pm ET.

Web The mortgage interest deduction is a common itemized deduction that allows homeowners to deduct the interest they pay on any loan used to build purchase. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The limit on deductions is shared between up to two personal residences.

Complete Edit or Print Tax Forms Instantly. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The interest on a home equity loan is tax-deductible if the loan is used to purchase build or improve your main home.

Web are refinance fees tax deductible home refinance tax implications mortgage interest deduction refinancing mortgage interest deduction limit mortgage interest. Web The limit on mortgage interest deductions has been lowered after the Tax Cuts and Jobs Act. Web 39 mortgage interest limitation worksheet Minggu.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

Web You also cant deduct the interest on any portion of your mortgage debt that exceeds 750000 375000 for single taxpayers or married taxpayers who file. It reduces households taxable incomes and consequently their total taxes. Web About Publication 936 Home Mortgage Interest Deduction Internal Revenue Service Home Forms and Instructions About Publication 936 Home Mortgage.

A personal residence is any home you own that is not classified as an investment property. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Before Dec 15 2017 the mortgage interest deduction limit was 1 million.

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Mortgage Interest Deduction How It Calculate Tax Savings

Crc Def14a 20200506 Htm

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

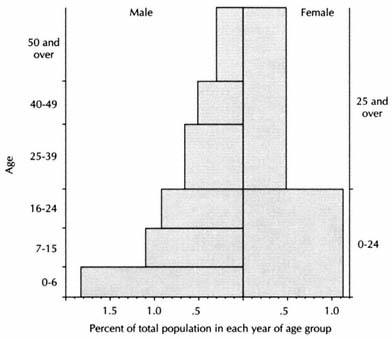

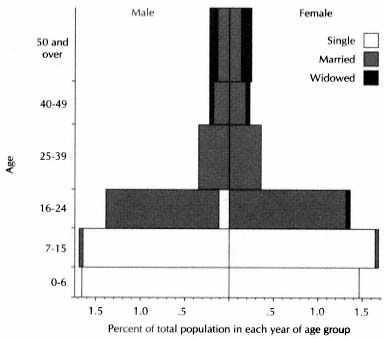

Rural Change And Royal Finances In Spain D0e13063

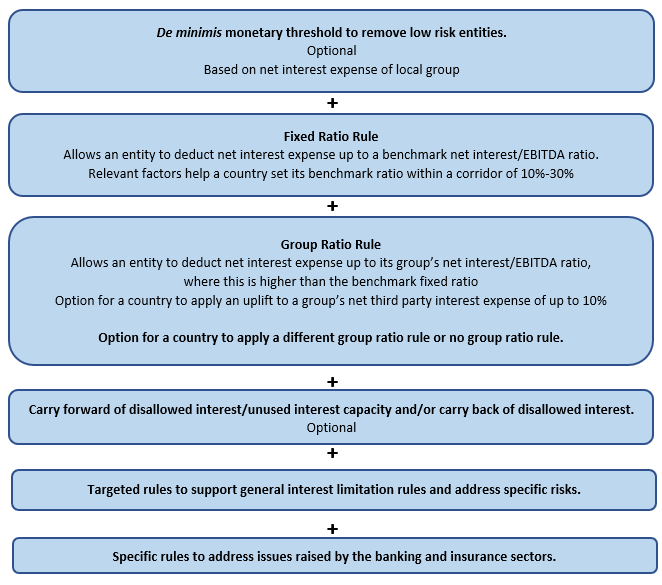

Thin Capitalization Restriction Of Interest Under Section 94b Next Litigation Saga Sbsandco

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Rural Change And Royal Finances In Spain D0e13063

Maximum Mortgage Tax Deduction Benefit Depends On Income

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Rules Limits For 2023

Midas Htm

Fundamental Tax Reform Options For The Mortgage Interest Deduction Everycrsreport Com

The History And Possible Future Of The Mortgage Interest Deduction